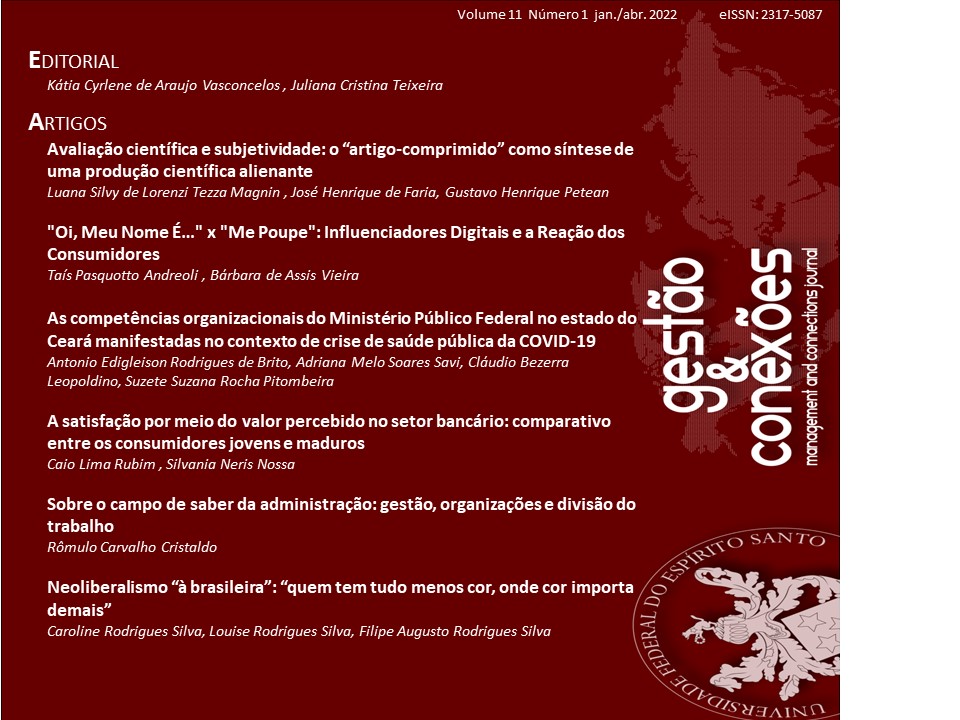

A satisfação por meio do valor percebido no setor bancário: comparativo entre os consumidores jovens e maduros

DOI:

https://doi.org/10.47456/regec.2317-5087.2022.11.1.32070.81-103Palavras-chave:

percepção de valor, satisfação, coortesResumo

O objetivo deste trabalho foi investigar como ocorre a relação da satisfação de clientes de serviços bancários com os atributos que formam o valor percebido (reputação, qualidade do serviço, conveniência e sacrifício monetário) quando se analisa a percepção de clientes jovens versus maduros. Foi realizada análise de duas amostras de clientes bancários, 251 respondentes de 18 a 30 anos (jovens) e 267 acima de 50 anos (maduros). Procede-se ao teste de diferença de médias e regressão linear múltipla e os resultados apontaram diferença de médias entre os públicos e que todos os construtos da percepção de valor em relação à satisfação foram estatisticamente significantes e positivos. A interação dos construtos entre jovens e maduros por intermédio da análise de regressão linear múltipla apontou que somente qualidade do serviço foi significante, em ambos os casos.

Referências

Ahn, S. J., & Lee, S. H. (2019). The Effect of Consumers’ Perceived Value on Acceptance of an Internet-Only Bank Service. Sustainability, 11(17), 4599. https://doi.org/10.3390/su11174599

Al-Jazzazi, A., & Sultan, P. (2017). Demographic differences in Jordanian bank service quality perceptions. International Journal of Bank Marketing, 35(2), 275-297. https://doi.org/10.1108/IJBM-07-2016-0091

Amin, M., Isa, Z., & Fontaine, R. (2013). Islamic banks. International Journal of Bank Marketing, 31(2), 79-97. https://doi.org/10.1108/02652321311298627

Augustine, O., & Kingsley, N. K. (2020).. Assessment of the Banking Behaviour of Generation Y University Students and the Future of Retail Banking in North Central Nigeria. Electronic Research Journal of Social Sciences and Humanities, 2(1).

Bakar, J. A., Clemes, M. D., & Bicknell, K. (2017). A comprehensive hierarchical model of retail banking. International Journal of Bank Marketing, 35(4), 662-684. https://doi.org/10.1108/IJBM-03-2016-0041

Berraies, S., Yahia, K. B., & Hannachi, M. (2017). Identifying the effects of perceived values of mobile banking applications on customers. International Journal of Bank Marketing, 35(6), 1018-1038. https://doi.org/10.1108/IJBM-09-2016-0137

Blankson, C., Cheng, J. M. S., & Spears, N. (2007). Determinants of banks selection in USA, Taiwan and Ghana. International Journal of Bank Marketing, 25(7), 469-489. https://doi.org/10.1108/02652320710832621

Boot, A., Hoffmann, P., Laeven, L., & Ratnovski, L. (2021). Fintech: What’s old, what’s new? Journal of Financial Stability, 53, 100836. https://doi.org/10.1016/j.jfs.2020.100836

Bushman, R. M., & Wittenberg‐Moerman, R. (2012). The role of bank reputation in “certifying” future performance implications of borrowers’ accounting numbers. Journal of Accounting Research, 50(4), 883-930. https://doi.org/10.1111/j.1475-679X.2012.00455.x

Cronin, J. J. Jr., Brady, M. K., & Hult, G. T. M. (2000). Assessing the effects of quality, value, and customer satisfaction on consumer behavioral intentions in service environments. Journal of Retailing, 76(2), 193-218. https://doi.org/10.1016/S0022-4359(00)00028-2

Davey, P., & Balakrishnan, L. (2017). A Study on Factors Influencing Brand Preferences among Baby Boomers and Generation Y Buyers in Passenger Car Segment Focussing Chennai Region. International Journal of Management Sciences and Business Research, 6(4).

Dhanapal, S., Vashu, D., & Subramaniam, T. (2015). Perceptions on the challenges of online purchasing: a study from “baby boomers”, generation “X” and generation “Y” point of views. Contaduría y Administración, 60, 107-132. https://doi.org/10.1016/j.cya.2015.08.003

Gan, C., Clemes, M., Wei, J., & Kao, B. (2011). An empirical analysis of New Zealand bank customers’ satisfaction. Banks and Bank Systems, 6(3), 63-77.

Garzaro, D. M., Varotto, L. F., & Pedro, S. (2020). Internet and mobile banking: The role of engagement and experience on satisfaction and loyalty. International Journal of Bank Marketing, 39(1), 1-23. https://doi.org/10.1108/IJBM-08-2020-0457

George, A., & Kumar, G. G. (2014). Impact of service quality dimensions in internet banking on customer satisfaction. Decision, 41(1), 73-85. https://doi.org/10.1007/s40622-014-0028-2

Gurău, C. (2012). A life‐stage analysis of consumer loyalty profile: comparing Generation X and Millennial consumers. Journal of Consumer Marketing, 29(2), 103-113. https://doi.org/10.1108/07363761211206357

Haq, W., & Muhammad, B. (2013). Customer satisfaction: A comparison of public and private banks of Pakistan. Proceedings of International Conference on Management Science and Engineering Management, USA, 6. https://doi.org/10.1007/978-1-4471-4600-1_45

Jung, K., & Kang, M. Y (2021). Understanding Credit Card Usage Behavior of Elderly Korean Consumers for Sustainable Growth: Implications for Korean Credit Card Companies. Sustainability, 13(7), 3817; https://doi.org/10.3390/su13073817

Kant, R., & Jaiswal, D. (2017). The impact of perceived service quality dimensions on customer satisfaction. International Journal of Bank Marketing, 35(3), 411-430. https://doi.org/10.1108/IJBM-04-2016-0051

Kaura, V. (2013a). Antecedents of customer satisfaction: a study of Indian public and private sector banks. International Journal of Bank Marketing, 31(3), 167-186. https://doi.org/10.1108/02652321311315285

Kaura, V. (2013b). Service convenience, customer satisfaction, and customer loyalty: Study of Indian commercial banks. Journal of Global Marketing, 26(1), 18-27. https://doi.org/10.1080/08911762.2013.779405

Kaura, V., Prasad, C. S. D., & Sharma, S. (2015). Service quality, service convenience, price and fairness, customer loyalty, and the mediating role of customer satisfaction. International Journal of Bank Marketing, 33(4), 404-422. https://doi.org/10.1108/IJBM-04-2014-0048

Khan, N., Kadir, S. L. S. A,., & Hoe, H. Y. (2013). Exploring multi-dimensions of customer value in service industry. Australian Journal of Basic and Applied Sciences, 7(4), 43-55.

Kumar, A., & Lim, H. (2008). Age differences in mobile service perceptions: comparison of Generation Y and baby boomers. Journal of Services Marketing, 22(7), 568-577. https://doi.org/10.1108/08876040810909695

Larán, J. A., & Rossi, C. A. V. (2003). O poder da surpresa no processo emocional de formação da satisfação. Anais do Encontro Nacional dos Programas de Pós-Graduação em Administração, Atibaia, SP, 27.

Laukkanen, T., Sinkkonen, S., Kivijärvi, M., & Laukkanen, P. (2007). Innovation resistance among mature consumers. Journal of Consumer Marketing, 24(7), 419-427. https://doi.org/10.1108/07363760710834834

Mainardes, E. W., Teixeira, A., & Romano, P.C.S. (2017). Determinants of co-creation in banking services. International Journal of Bank Marketing, 35(2), 187-204. https://doi.org/10.1108/IJBM-10-2015-0165

Marcos, A., & Coelho, A. (2017). Antecedents and consequences of perceived value in the insurance industry. European Journal of Applied Business Management, 3(2), 29-51.

Matzler, K., Würtele, A., & Renzl, B. (2006). Dimensions of price satisfaction: a study in the retail banking industry. International Journal of Bank Marketing, 24(4), 216-231. https://doi.org/10.1108/02652320610671324

Milner, T., & Rosenstreich, D. (2013). Insights into mature consumers of financial services. Journal of Consumer Marketing, 30(3), 248-257. https://doi.org/10.1108/07363761311328919

Narteh, B. (2013). Key determinant factors for retail bank switching in Ghana. International Journal of Emerging Markets, 8(4), 409-427. https://doi.org/10.1108/IJoEM-01-2011-0004

Narteh, B. (2018). Service quality and customer satisfaction in Ghanaian retail banks: the moderating role of price. International Journal of Bank Marketing, 36(1), 68-88. https://doi.org/10.1108/IJBM-08-2016-0118

Parente, E. S., Costa, F. J., & Leocádio, A. L. (2015). Conceptualization and measurement of customer perceived value in banks. International Journal of Bank Marketing, 33(4), 494-509. https://doi.org/10.1108/IJBM-04-2014-0051

Parment, A. (2013). Generation Y vs. Baby Boomers: Shopping behavior, buyer involvement and implications for retailing. Journal of Retailing and Consumer Services, 20(2), 189-199. https://doi.org/10.1016/j.jretconser.2012.12.001

Phan, D. H. B., Narayan, P. K., Rahman, R. E., & Hutabarat, A. R. (2020). Do financial technology firms influence bank performance? Pacific-Basin Finance Journal, 62, 101-210. https://doi.org/10.1016/j.pacfin.2019.101210

Ponnam, A., & Paul, R. (2017). Relative importance of service value by customer relationship stages. International Journal of Bank Marketing, 35(2), 319-334. https://doi.org/10.1108/IJBM-04-2016-0056

Rafael, D. N., & Lopes, E. L. (2019). The Effect of Reactance on Satisfaction: A Study in the Context of Supplementary Health Care Systems. Brazilian Business Review, 16(2), 102-117. https://doi.org/10.15728/bbr.2019.16.2.1

Raithel, S., Wilczynski, P., Schloderer, M. P., & Schwaiger, M. (2010). The value-relevance of corporate reputation during the financial crisis. Journal of Product & Brand Management, 19(6), 389-400. https://doi.org/10.1108/10610421011085703

Roig, J. C. F., Garcia, J. S., Tena, M. A. M., & Monzonis, J. L. (2006). Customer perceived value in banking services. International Journal of Bank Marketing, 24(5), 266-283. https://doi.org/10.1108/02652320610681729

Roig, J. C. F., Guillén, M. E., Coll, S. F., & Saumell, R. P. (2013). Social value in retail banking. International Journal of Bank Marketing, 31(5), 348-367. https://doi.org/10.1108/IJBM-02-2013-0013

Ruiz, B., Garcia, J. A., & Revilla, J. A. (2016). Antecedents and consequences of bank reputation: A comparison of the United Kingdom and Spain. International Marketing Review, 33(6).781-805. https://doi.org/10.1108/IMR-06-2015-0147

Sánchez-Fernández, R. & Iniesta-Bonillo, M. A. (2006). Consumer perception of value: Literature review and a new conceptual framework. Journal of Consumer Satisfaction, Dissatisfaction and Complaining Behavior, 19, 40-58.

Sandhu, S., & Arora, S. (2020). Customers' usage behaviour of e‐banking services: Interplay of electronic banking and traditional banking. International Journal of Finance & Economics, 1, 1-13. https://doi.org/10.1002/ijfe.2266

Sayani, H. (2015). Customer satisfaction and loyalty in the United Arab Emirates banking industry. International Journal of Bank Marketing, 33(3), 351-375. https://doi.org/10.1108/IJBM-12-2013-0148

Severgnini, E., Galdaméz, E. V. C., & Moraes, R. O. (2018). Satisfaction And Contribution Of Stakeholders From The Performance Prism Model. Brazilian Business Review, 15(2), 120-134. https://doi.org/10.15728/bbr.2018.15.2.2

Singh, S., Sahni, M. M., & Kovid, R. K. (2020). What drives FinTech adoption? A multi-method evaluation using an adapted technology acceptance model. Management Decision, 58(8), 1675-1697. https://doi.org/10.1108/MD-09-2019-1318

Sirdeshmukh, D., Singh, J., & Sabol, B. (2002). Consumer trust, value, and loyalty in relational exchanges. Journal of Marketing, 66(1), 15-37. https://doi.org/10.1509/jmkg.66.1.15.18449

Stanley, T. O., Ford, J. K., & Richards, S. K. (1985). Segmentation of bank customers by age. International Journal of Bank Marketing, 3(3), 56-63. https://doi.org/10.1108/eb010761

Sweeney, J. C., & Soutar, G. N. (2001). Consumer perceived value: The development of a multiple item scale. Journal of Retailing, 77(2), 203-220. https://doi.org/10.1016/S0022-4359(01)00041-0

Tesfom, G., & Birch, N. J. (2011). Do switching barriers in the retail banking industry influence bank customers in different age groups differently? Journal of Services Marketing, 25(5), 371-380. https://doi.org/10.1108/08876041111149720

Thompson, K. H., Ellis, D., Soni, S., & Paterson, S. (2017). Attributes influencing clothing store choice for an emerging market’s Generation Y Twixter customers. The International Review of Retail, Distribution and Consumer Research, 28(2), 157-173. https://doi.org/10.1080/09593969.2017.1357647

Titko, J., & Lace, N. (2012). Bank value: comparing customer and employee perceptions. Business, Management and Education, 10(1), 66-76.

Trasorras, R., Weinstein, A., & Abratt, R. (2009). Value, satisfaction, loyalty and retention in professional services. Marketing Intelligence & Planning, 27(5), 615-632. https://doi.org/10.1108/02634500910977854

Treen, E., Pitt, L., Bredican, J., & Farshid, M. (2017). App service: How do consumers perceive the quality of financial service apps on smart devices? Journal of Financial Services Marketing, 22(3), 119-125. https://doi.org/10.1057/s41264-017-0029-2

Tucker, M. & Jubb, C. (2018). Bank and product selection–an Australian student perspective. International Journal of Bank Marketing, 36(1), 126-146. https://doi.org/10.1108/IJBM-10-2016-0151

Vera, J. & Trujillo, A. (2013). Service quality dimensions and superior customer perceived value in retail banks: An empirical study on Mexican consumers. Journal of Retailing and Consumer Services, 20(6), 579-586. doi: https://doi.org/10.1016/j.jretconser.2013.06.005

Williams, K. C., & Page, R. A. (2011). Marketing to the generations. Journal of behavioral studies in business, 3(1), 37-53.

Wolf, M. M., Carpenter, S., & Qenani-Petrela, E. (2005). A comparison of X, Y, and Boomer generation wine consumers in California. Journal of Food Distribution Research, 36(856-2016-57473), 186-191. https://doi.org/10.22004/ag.econ.26724

Zacharias, M. L. B., Figueiredo, K. F., & Almeida, V. M. C. (2008). Determinantes da satisfação dos clientes com serviços bancários. RAE eletrônica, 7(2), 1-23. https://doi.org/10.1590/S1676-56482008000200002

Zameer, H., Tara, A., Kausar, U., & Mohsin, A. (2015). Impact of service quality, corporate image and customer satisfaction towards customers’ perceived value in the banking sector in Pakistan. International Journal of Bank Marketing 33(4), 442-456. https://doi.org/10.1108/IJBM-01-2014-0015

Downloads

Publicado

Edição

Seção

Licença

Os direitos autorais dos originais aprovados serão automaticamente transferidos à Revista, como condição para sua publicação, e para encaminhamentos junto às bases de dados de indexação de periódicos científicos.

Esta cessão passará a valer a partir da submissão do manuscrito, em formulário apropriado, disponível no Sistema Eletrônico de Editoração da Revista.

A revista se reservará o direito de efetuar, nos originais, alterações de ordem normativa, ortográfica e gramatical, com vistas a manter o padrão culto da língua e a credibilidade do veículo. Respeitará, no entanto, o estilo de escrever dos(as) autores(as).

Alterações, correções ou sugestões de ordem conceitual serão encaminhadas aos(às) autores(as), quando necessário. Nesses casos, os artigos, depois de adequados, deverão ser submetidos a nova apreciação.

As provas finais serão encaminhadas aos(às) autores(as).

Os trabalhos publicados passarão a ser de propriedade da Revista, ficando sua re-impressão (total ou parcial) sujeita à autorização expressa da Revista. Em todas as citações posteriores, deverá ser consignada a fonte original de publicação: Revista Gestão & Conexões.

A Universidade Federal do Espírito Santo e/ou quaisquer das instâncias editoriais envolvidas com o periódico não se responsabilizarão pelas opiniões, idéias e conceitos emitidos nos textos. As opiniões emitidas pelos(as) autores(as) dos artigos serão de sua exclusiva responsabilidade.

Em todo e qualquer tipo de estudo que envolva situações de relato de caso clínico é fundamental o envio de cópia do Termo de Consentimento Livre e Esclarecido assinado(s) pelo(s) paciente(s).