Governança corporativa e qualidade das informações contábeis

DOI:

https://doi.org/10.47456/bjpe.v8i4.38720Palavras-chave:

Governança corporativa, Empresa familiar, Qualidade da informação contábilResumo

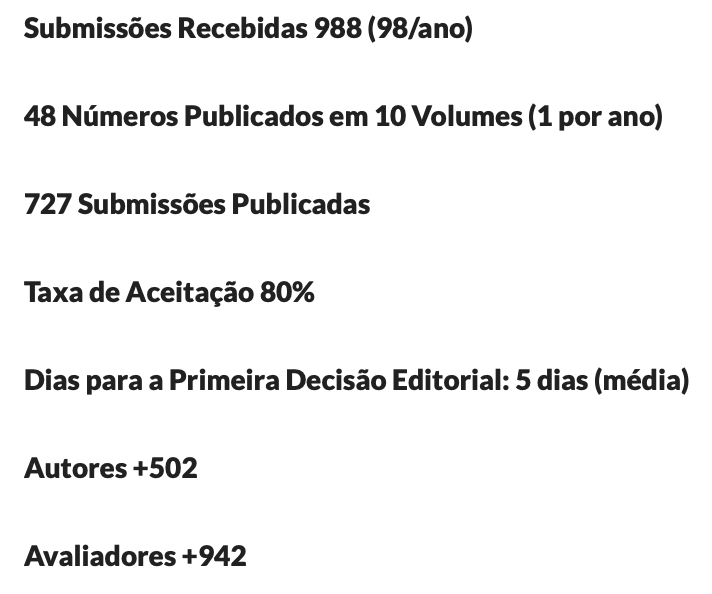

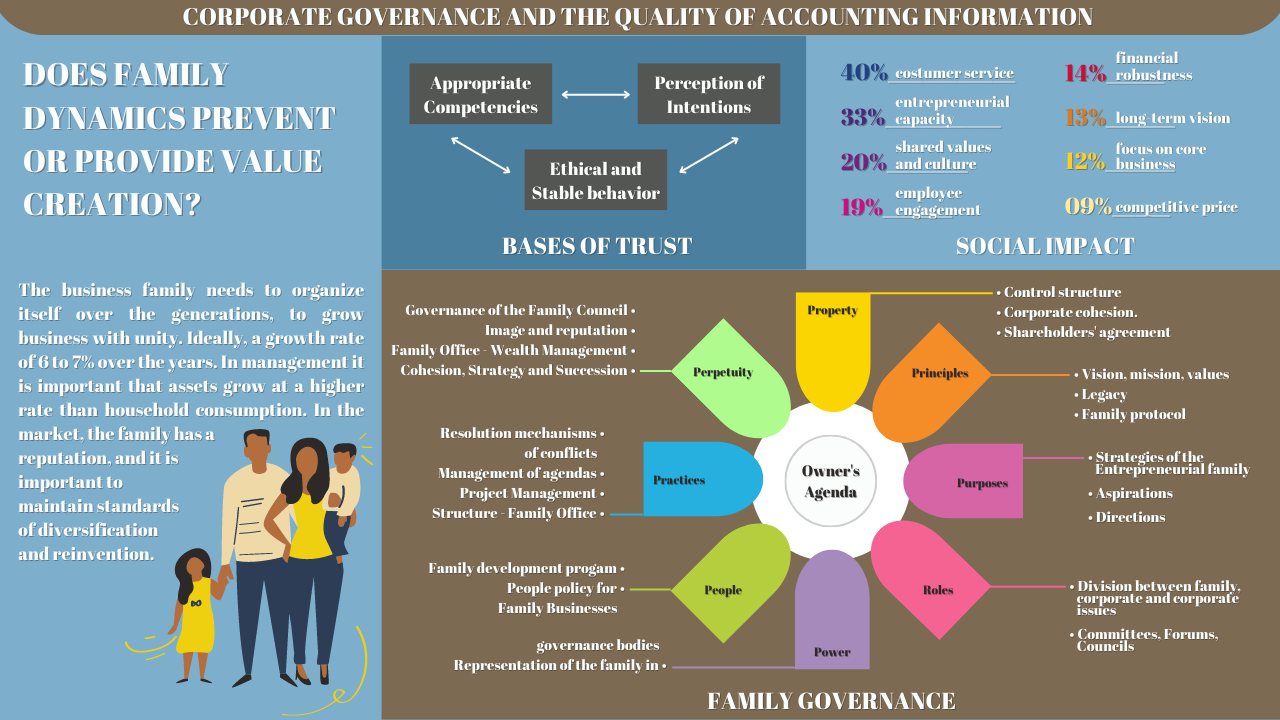

Objetivo - O objetivo deste estudo é destacar a influência da governança corporativa na qualidade da informação contábil em empresas familiares, especialmente os principais mecanismos de governança que influenciam as propriedades da qualidade da informação contábil. Desenho / metodologia / abordagem - Com base em dados de 333 artigos de pesquisa, adotamos o método bibliométrico para mapear a literatura e também divulgar o conhecimento científico. Resultados - Os resultados obtidos, apoiados na literatura, indicam que os mecanismos de governança corporativa influenciam positivamente a qualidade da informação contábil nas empresas familiares. Originalidade / valor - A literatura seletiva e relevante forneceu fontes de informação para os autores do estudo discutirem a crescente importância das empresas familiares e o papel da governança corporativa e da qualidade da informação contábil em todo o mundo. O estudo inclui os principais autores que contribuíram para o desenvolvimento de um importante tema relacionado à complexidade da empresa familiar, o que constitui um desafio para pesquisadores e profissionais, reforçando a originalidade do presente estudo.

Downloads

Referências

Adıgüzel, H. (2013). Corporate Governance, Family Ownership and Earnings Management: Emerging Market Evidence. Accounting anf Finance Research. 2. 17-33. https://dx.doi.org/10.5430/afr.v2n4p17 DOI: https://doi.org/10.5430/afr.v2n4p17

Aguilera, R. V. & Cazurra, A. C. (2009). Codes of Good Governance. Corporate Governance: An International Review, 17(3), 1-13. DOI: https://doi.org/10.1111/j.1467-8683.2009.00737.x

Al-Shammari, B. & Al-Sultan, W. (2010). Corporate governance and voluntary disclosure in Kuwait. International Journal of Disclosure and Governance. 7. 262-280. https://dx.doi.org/10.1057/jdg.2010.3 DOI: https://doi.org/10.1057/jdg.2010.3

Ali, A., Chen, T-Y., & Radhakrishnan, S. (2007). Corporate disclosures by family firms. Journal of Accounting and Economics, 44, 238-286. DOI: https://doi.org/10.1016/j.jacceco.2007.01.006

Aronoff, C. & Ward, J. (1996). Family Business Governance: Maximizing Family and Business Potential, 3rd edn. Marietta, GA: Family Business Publishers.

Astrachan, J. H., Klein, S. B., & Smyrnios, K. X. (2002). The F‐PEC scale of family influence: A proposal for solving the family business definition problem. Family Business Review, 15(1), 45-58. https://dx.doi.org/10.1111/j.1741- 6248.2002.00045.x DOI: https://doi.org/10.1111/j.1741-6248.2002.00045.x

Ball, R. & Shivakumar, L. (2005). Earnings quality UK private firms: comparative loss recognition timeliness. Journal of Accounting and Economics 39(1): 83-128. DOI: https://doi.org/10.1016/j.jacceco.2004.04.001

Ball, R. J. & Brown, W. (1968). An empirical evaluation of accounting income numbers. Journal of Accounting Research, 6, 159-178. DOI: https://doi.org/10.2307/2490232

Ball, R., S. P. Kothari, & Robin, A. (2000). The Effect of International Institutional Factors on Properties of Accounting Earnings. Journal of Accounting and Economics, 29, 1-51. DOI: https://doi.org/10.1016/S0165-4101(00)00012-4

Bao, S. R. & Lewellyn, K. B. (2017). Ownership structure and earnings management in emerging markets - An institutionalized agency perspective. International Business Review. DOI: https://doi.org/10.1016/j.ibusrev.2017.02.002

Barth, M. E., Landsman, W. R., & Lang, M. (2008). International accounting standards and accounting quality. Journal of Accounting Research, 46, 467-498. DOI: https://doi.org/10.1111/j.1475-679X.2008.00287.x

Basu, S. (1997). The conservatism principle and the asymmetric timeliness of earnings. Journal of Accounting & Economics 24, 3-37 DOI: https://doi.org/10.1016/S0165-4101(97)00014-1

Berle, A. & Means, G. (1932). The Modern Corporation and Private Property. New York: Macmillan.

Beaver, W. H. (1968). The Information Content of Annual Earnings Announcements. Journal of Accounting Research, 6, 67-92. DOI: https://doi.org/10.2307/2490070

Beaver, W. (1981) Financial reporting: An accounting revolution. Journal of Accounting and Economics, 3. 243-252. DOI: https://doi.org/10.1016/0165-4101(81)90005-7

Biddle, G. & Hilary, G. (2006). Accounting quality and firm-level capital investment. The Accounting Review, 81(5): 963-982. DOI: https://doi.org/10.2308/accr.2006.81.5.963

Bonaccorsi, M. F. (2016). Governança Jurídica nas Empresas Familiares. 1. ed. Belo Horizonte: Editora Del Rey. v. 1.

Burkart, M., Panunzi, F., & Shleifer, A. (2003) Family Firms. The Journal of Finance. 58(5), 2167-2201. DOI: https://doi.org/10.1111/1540-6261.00601

Bushman, R., Chen, Q., Engel, E., & Smith, A. (2000). The sensitivity of corporate governance systems to the timeliness of accounting earnings. Working Paper. Chapell Hill, University of North Carolina, 63 p. DOI: https://doi.org/10.2139/ssrn.241939

Cadbury, A. (1992) Report of the Committee on the Financial Aspects of Corporate Governance, London, Gee Publishing. DOI: https://doi.org/10.1093/oso/9780198258599.003.0003

Cândido, R. B., Tambosi, E., Filho, & Kuniyoshi, M. S. (2016) Os Principais trabalhos sobre CAPM condicional no Web of Science: uma análise de citações e cocitações entre 2000-2014. Revista de Administração da UEG (RAUEG), 7(2), 114-128.

Cascino, S., Pugliese, A., Mussolino, D., & Sansone, C. (2010). The Influence of Family Ownership on the Quality of Accounting Information. Family Business Review. 23. https://dx.doi.org/10.1177/0894486510374302 DOI: https://doi.org/10.1177/0894486510374302

Casillas, J. C. & Acedo, F. (2007). Evolution of the intellectual structure of family business literature: a bibliometric study of FBR. Family Business Review, 20(2), 141-162. DOI: https://doi.org/10.1111/j.1741-6248.2007.00092.x

Chen, J. J. & Zhang, H. (2014). The impact of the corporate governance code on earnings management– Evidence from Chinese listed companies. European Financial Management, 20(3), 596-632. DOI: https://doi.org/10.1111/j.1468-036X.2012.00648.x

Chua, J. H., Chrisman, J. J., & Sharma, P. (1999). Defining the family business by behavior. Entrepreneurship Theory and Practice, 23, 19–39. DOI: https://doi.org/10.1177/104225879902300402

Cohen, J, Krishnamoorthy, G., & Wright, A. (2004), “The Corporate Governance Mosaic and Financial Reporting Quality”, Journal of Accounting Literature, 23, 87-152.

Costa-Neto, P. L. de O. (1977). Estatística. 1. ed. São Paulo: Edgard Blücher.

Dechow, P. M. & Schrand, C. M. (2004) Earnings Quality. CFA Institute, Charlottesville, Virginia.

Dechow, P., W. Ge, & Schrand, C. M. (2010). Understanding earnings quality: a review of the proxies, their determinants and their consequences. Journal of Accounting and Economics 50(2–3): 344-401. DOI: https://doi.org/10.1016/j.jacceco.2010.09.001

Donnelley, R. G. (1964) The family business. Havard Business Review, 42(4), 93-105.

Ecker, F. et al. (2013). Estimation sample selection for discretionary accruals models. Journal of Accountingand Economics, 56, 190-211. DOI: https://doi.org/10.1016/j.jacceco.2013.07.001

Faccio, M. & Lang, L. H. P. (2002) The Ultimate Shareholdership of Western European Corporations. Journal of Financial Economics, 65, 365-395. http://dx.doi.org/10.1016/S0304-405X(02)00146-0 DOI: https://doi.org/10.1016/S0304-405X(02)00146-0

Fahimnia, B., Sarkis, J., & Davarzani, H. (2015). Green supply chain management: a review and bibliometric analysis. International Journal of Production Economics, 162, 101-114. DOI: https://doi.org/10.1016/j.ijpe.2015.01.003

Fathi, J. (2013). The determinants of the quality of financial information disclosed by French listed companies. Mediterranean Journal of Social Sciences, 4(2), 319-336. http://dx.doi.org/10.5901/mjss.2013.v4n2p319 DOI: https://doi.org/10.5901/mjss.2013.v4n2p319

Ferramosca, S. & Ghio, A. (2018). Accounting choices in family firms an analysis of influences and implications. Retrieved http://www.springer.com/series/1505 DOI: https://doi.org/10.1007/978-3-319-73588-7

Firth, M., Fung, P., & Rui, O. (2007). Ownership, two-tier Board Structure, and the Informativeness of Earnings: Evidence from China. Journal of Accounting and Public Policy, 26(4), 463-496. DOI: https://doi.org/10.1016/j.jaccpubpol.2007.05.004

Gaio, C. (2010). The relative importance of firm and country characteristics for earnings quality round the world. European Accounting Review, 19(4), 693-738. http://dx.doi.org/10.1080/09638180903384643 DOI: https://doi.org/10.1080/09638180903384643

Gallo, M. & Kenyon-Rouvinez, D. (2005). The importance of family and business governance. In Kenyon-Rouvinez, D. and Ward, J. L. (eds), Family Business. Key Issues. Basingstoke: Palgrave/Macmillan, 45-57. DOI: https://doi.org/10.1057/9780230287730_4

García, M. D. P. R., Alejandro, K. A. C., Sáenz, A. B. M., & Sánchez, H. H. G. (2016). Does an IFRS adoption increase value relevance and earnings timeliness in Latin America? Emerging Markets Review.

Gersick, K., Davis, J., Hampton, M., & Lansberg, I. (1997) De geração para geração: Ciclo de vida da empresa familiar. 2ed. São Paulo: Negócio, p. 308.

Gersick, K. E., Davis, J. A., Hampton, M. M., & Lansberg, I. (2006). De geração para geração: ciclos de vida das empresas familiares. 1. ed. Rio de Janeiro: Editora Elsevier.

Giroud, X. & Mueller, H. M. (2011). “Corporate Governance, Product Market Competition, and Equity Prices.” Journal of Finance, 66, 563-600 DOI: https://doi.org/10.1111/j.1540-6261.2010.01642.x

Gómez-Mejía, L. R., Cruz, C., Berrone, P., & De Castro, J. (2011). The bindthat ties: Socioemotional wealth preservation in family firms. The Academyof Management Annals, 5(1), 653-707. DOI: https://doi.org/10.5465/19416520.2011.593320

González, J. & García-Meca, E. (2014). Does Corporate Governance Influence Earnings Management in Latin American Markets? Journal of Business Ethics. 121. https://dx.doi.org/10.1007/s10551-013-1700-8

Gonzalez, J. S. & Garcia-Meca, E. (2014). Does corporate governance influence earnings management in Latin American markets? Journal of Business Ethics, 121(3), 419-440. DOI: https://doi.org/10.1007/s10551-013-1700-8

Gu X. & Lı X. (2016). How to improve the quality of accounting information based on the corporate governance. M&D Forum, 201-208.

Habbash, M., Xiao, L., Salama, A., & Dixon, R. (2014). Are independent directors and supervisory directors effective in constraining earnings management? Journal of Finance, Accounting and Management, 5(1), 125-160.

Holderness, C. G. (2009) The Myth of Diffuse Ownership in the United States. The Review of Financial Studies, 22(4), 1377–1408. DOI: https://doi.org/10.1093/rfs/hhm069

IASB – IFRS Foundation and International Accounting Standards Board. Due process handbook for the IASB. Acesso em: 03 set. 2012, 2018.

Isidro, H. & Raonic, I. (2012). Firm incentives, institutional complexity and the quality of “harmonized” accounting numbers. The International Journal of Accounting, 47(4), 407-436. https://doi.org/10.1016/j.intacc.2012.10.007 DOI: https://doi.org/10.1016/j.intacc.2012.10.007

Jenkins, D. S., Kane, G. D., & Velury, U. (2009). Earnings Conservatism and Value Relevance Across the Business Cycle. Journal of Business Finance & Accounting 36(9–10), 1041-1058. DOI: https://doi.org/10.1111/j.1468-5957.2009.02164.x

Jensen, M. & Meckling, W. (1976) Theory of the firm: managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360. DOI: https://doi.org/10.1016/0304-405X(76)90026-X

Jonkers, K. & Derrick, G. (2012). The bibliometric bandwagon: Characteristics of bibliometric articles outside the field literature. Journal of the American Society for Information Science and Technology, 63(4); 829-836. DOI: https://doi.org/10.1002/asi.22620

Kothari S. P. (2000). The role of financial reporting in reducing financial risks in the market. EconPapers: Conference Series. [Proceedings] (repec.org), 44, issue Jun, 89-112

Lakhal, N. (2015). Corporate disclosure, ownership structure and earnings management: the case of french-listed firms. Journal of Applied Business Research. 31. 1493-1504. https://dx.doi.org/10.19030/jabr.v31i4.9332 DOI: https://doi.org/10.19030/jabr.v31i4.9332

La Porta, R., Lopez-De-Silanes, F., & Shleifer, A. (1999) Corporate Ownership Around the World. The Journal of Finance 54(2), 471–517. DOI: https://doi.org/10.1111/0022-1082.00115

La Porta, R., Lopez-De-Silanes, F., Shleifer, A., & Vishny, R. (2000). Investor protection and corporate governance. Journal of Finance, 58:3-27. DOI: https://doi.org/10.1016/S0304-405X(00)00065-9

Leuz, C. (2003). IAS Versus U.S. GAAP: Information Asymmetry-based Evidence from Germany’s New Market. Journal of Accounting Research, 41: 445-427. DOI: https://doi.org/10.1111/1475-679X.00112

Makhlouf, M. (2013). Corporate governance and its impact on the quality of accounting information in the industrial community shareholding companies listed in amman financial market, Jordan. International Journal of Humanities and Social Science. 3. 184-195.

Morck, R. K., Shleifer, A., & Vishny, R. W. (1988) Management Ownership and Market Valuation: An Empirical Analysis. Journal of Financial Economics, 20, 293-315 Retrieved https://ssrn.com/abstract=1506393 DOI: https://doi.org/10.1016/0304-405X(88)90048-7

Mustakallio, M., Autio, E. & Zahra, S. A. (2002). Relational and contractual governance in family firms: effects on strategic decision making. Family Business Review, 15, 205–222. DOI: https://doi.org/10.1111/j.1741-6248.2002.00205.x

Nesrine, K. & Abdelwahed, O. (2010). Corporate Governance and Financial Reporting Quality: The Case of The Tunisian Firms. International Business Research. 4. https://dx.doi.org/10.5539/ibr.v4n1p158 DOI: https://doi.org/10.5539/ibr.v4n1p158

Ohlson, J. A. (1995), Earnings, book values, and dividends in equity valuation, Contemporary Accounting Research, 11(2), 661-687. DOI: https://doi.org/10.1111/j.1911-3846.1995.tb00461.x

Özçelik, H. (2018). Kurumsal Yönetim Temelinde Muhasebe Bilgi Kalitesinin Geliştirilmesi. Muhasebe ve Vergi Uygulamaları Dergisi. 485-507. https://dx.doi.org/10.29067/muvu.341191 DOI: https://doi.org/10.29067/muvu.341191

Paiva, K. C. M., Oliveira, M. C. S. M., & Melo, M. C. O. L. (2008) Produção científica brasileira sobre empresa familiar: um meta estudo de artigos publicados em anais de eventos da ANPAD no período de 1997-2007. Revista de Administração Mackenzie, 9(6), 148-173. DOI: https://doi.org/10.1590/S1678-69712008000600008

Pascual-Fuster, B. & Cladera, R. (2018). Politicians in the boardroom: Is it a convenient burden? Corporate Governance: An International Review. https://dx.doi.org/10.1111/corg.12261 DOI: https://doi.org/10.1111/corg.12261

Paulo, E., Cavalcante, P. R. N., & Melo, I. I. S. L., de. (2012). Accounting information quality in public stock and bond offerings by brazilian public companies. Brazilian Business Review, 9(1), 1-26. DOI: https://doi.org/10.15728/bbr.2012.9.1.1

Pilkington, A. & Meredith, J. (2009). The evolution of the intellectual structure of operations management - 1980–2006: A citation/co-citation analysis. Journal of Operations Management, 27(3), 185-202. https://dx.doi.org/10.1016/j.jom.2008.08.001 DOI: https://doi.org/10.1016/j.jom.2008.08.001

Richardson, R. J. (2015). Pesquisa Social: Métodos e Técnicas. 3. ed. São Paulo: Atlas.

Sharma, P. (2004). An Overview of the Field of Family Business Studies: Current Status and Directions for the Future. Family Business Review, 17(1),1-36. https://doi.org/10.1111/j.1741-6248.2004.00001.x DOI: https://doi.org/10.1111/j.1741-6248.2004.00001.x

Shleifer, A. & Vishny, R. W. (1997) A survey of Corporate Governance. The Journal of Finance, 52(2), 737-783. DOI: https://doi.org/10.1111/j.1540-6261.1997.tb04820.x

Siebels, J. & Zu, K. D. (2011). A Review of Theory in Family Business Research: The Implications for Corporate Governance. International Journal of Management Reviews. 14. https://dx.doi.org/10.1111/j.1468-2370.2011.00317.x DOI: https://doi.org/10.1111/j.1468-2370.2011.00317.x

Silva, R. L. M. (2013). Adoção completa das IFRS no Brasil: Qualidade das demonstrações contábeis e o custo de capital próprio (Tese de Doutorado em Ciências Contábeis, Departamento de Contabilidade e Atuária da Faculdade de Economia, Administração e Contabilidade, Universidade de São Paulo).

Sloan, R. G. (2001). Financial accounting and corporate governance: A discussion. Journal of Accounting and Economics, 32(1-3): 335-347. DOI: https://doi.org/10.1016/S0165-4101(01)00039-8

Stafford, K., Duncan, K. A., Dane, S., & Winter, M. (1999). A Research Model of Sustainable Family Businesses. Family Business Review, 12(3), 197-208. https://doi.org/10.1111/j.1741-6248.1999.00197.x DOI: https://doi.org/10.1111/j.1741-6248.1999.00197.x

Steiger, T., Duller, C., & Hiebl, M. (2015). No Consensus in Sight: An Analysis of Ten Years of Family Business Definitions in Empirical Research Studies. Journal of Enterprising Culture. 23. 25-62. https://dx.doi.org/10.1142/S0218495815500028 DOI: https://doi.org/10.1142/S0218495815500028

Sundaramurthy, C. (2008). Sustaining Trust Within Family Businesses. Family Business Review, 21(1), 89-102. https://doi.org/10.1111/j.1741-6248.2007.00110.x DOI: https://doi.org/10.1111/j.1741-6248.2007.00110.x

Tagiuri, R. & Davis, J. (1996). Bivalent attributes of the family firm. Family Business Review, 9, 199–208. DOI: https://doi.org/10.1111/j.1741-6248.1996.00199.x

Tahai, A. & Meyer, M. J. (1999). A Revealed Preference Study of Management Journals Direct Influences. Strategic Management Journal. 20. 279-296. https://dx.doi.org/10.1002/(SICI)1097-0266(199903)20:33.0.CO;2-2 DOI: https://doi.org/10.1002/(SICI)1097-0266(199903)20:3<279::AID-SMJ33>3.0.CO;2-2

Treinta, F. T., Farias, J. R., Filho, Sant'Anna, A. P., & Rabelo, L. M. (2014). Metodologia de pesquisa bibliográfica com a utilização de método multicritério de apoio à decisão. Production, 24(3), 508-520. https://dx.doi.org/10.1590/S0103-65132013005000078 DOI: https://doi.org/10.1590/S0103-65132013005000078

Uwuigbe, U., Peter, D. S., & Oyeniyi, A. (2014) 'The effects of corporate governance mechanisms on earnings management of listed firms in Nigeria', Accounting and Management Information Systems 13(1), 159-174.

Vergara, S. C. (2014). Projetos e Relatórios de Pesquisa em Administração. 15. ed. São Paulo: Atlas.

Verleun, G., Sotiropoulos, & Vasileiou (2011), The Sarbanes-Oxley Act and Accounting Quality: A Comprehensive Examination. International Journal of Economics and Finance, 3(5), 49-64. DOI: https://doi.org/10.5539/ijef.v3n5p49

Villalonga, B. & Amit, R. (2004). How do family ownership, control, and management affect firm value? Harvard Business School and Wharton School, University of Pennsylvania. DOI: https://doi.org/10.2139/ssrn.556032

Yoon, S. (2007). Accounting Quality and International Accounting Convergence (Doctoral dissertation, Oklahoma State University) - Oklahoma State University, Oklahoma.

Zahra, S. & Sharma, P. (2004). Family business research: A strategic reflection. Family Business Review, 17(4), 331-346. DOI: https://doi.org/10.1111/j.1741-6248.2004.00022.x

Zellweger, T. M., Nason, R. S., & Nordqvist, M. (2011). From longevity of firms to transgenerational entrepreneurship of families: Introducing family entrepreneurial orientation. Family Business Review, 25(2), 136-155. https://dx.doi.org/10.1177/0894486511423531 DOI: https://doi.org/10.1177/0894486511423531

Zupic, I. & Cater, T. (2015). Bibliometric methods in management and organization. Organizational Research Methods, 18(3), 429-472. DOI: https://doi.org/10.1177/1094428114562629

Wang, D. (2006). Founding family ownership and earnings quality. Journal of Accounting Research, 44(3), 619-656. DOI: https://doi.org/10.1111/j.1475-679X.2006.00213.x

Watts, R. & Zimmerman, J. (1986). Positive Accounting Theory, Edgewood Cliffs, NJ: Prentice Hall.

Wellalage, N. H., Locke, S., & Scrimgeour, F. (2012). Does one size fit all? An empirical investigation of board structure on family firms' financial performance. Afro-Asian Journal of Finance and Accounting, 3(2), 182-194. DOI: https://doi.org/10.1504/AAJFA.2012.048248

Wong, L. (2011). Corporate governance in small firms: The need for cross-cultural analysis? International Journal of Cross Cultural Management, 11(2),167-183. https://doi.org/10.1177/1470595811399188 DOI: https://doi.org/10.1177/1470595811399188

Publicado

Como Citar

Edição

Seção

Licença

Copyright (c) 2022 Brazilian Journal of Production Engineering

Este trabalho está licenciado sob uma licença Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.

Atribuição 4.0 internacional CC BY 4.0 Deed

Esta licença permite que outros remixem, adaptem e desenvolvam seu trabalho não comercialmente, contanto que eles creditem a você e licenciem suas novas criações sob os mesmos termos.